Small Spending Changes Create a Brighter Future for Family

All families can save. Some don’t know where to start.

Wade and Lizz Pendergrass are hard workers who do whatever they can to support themselves and their seven-year-old son, Logan.

But Wade’s Sous Chef job and Lizz’s McDonald’s salary only brought in $38,400 a year, making them live paycheck to paycheck.

the couple saw a flyer for Explorations V Children’s Museum’s Storybook Camp and were able to enroll Logan thanks to the Museum’s scholarship program.

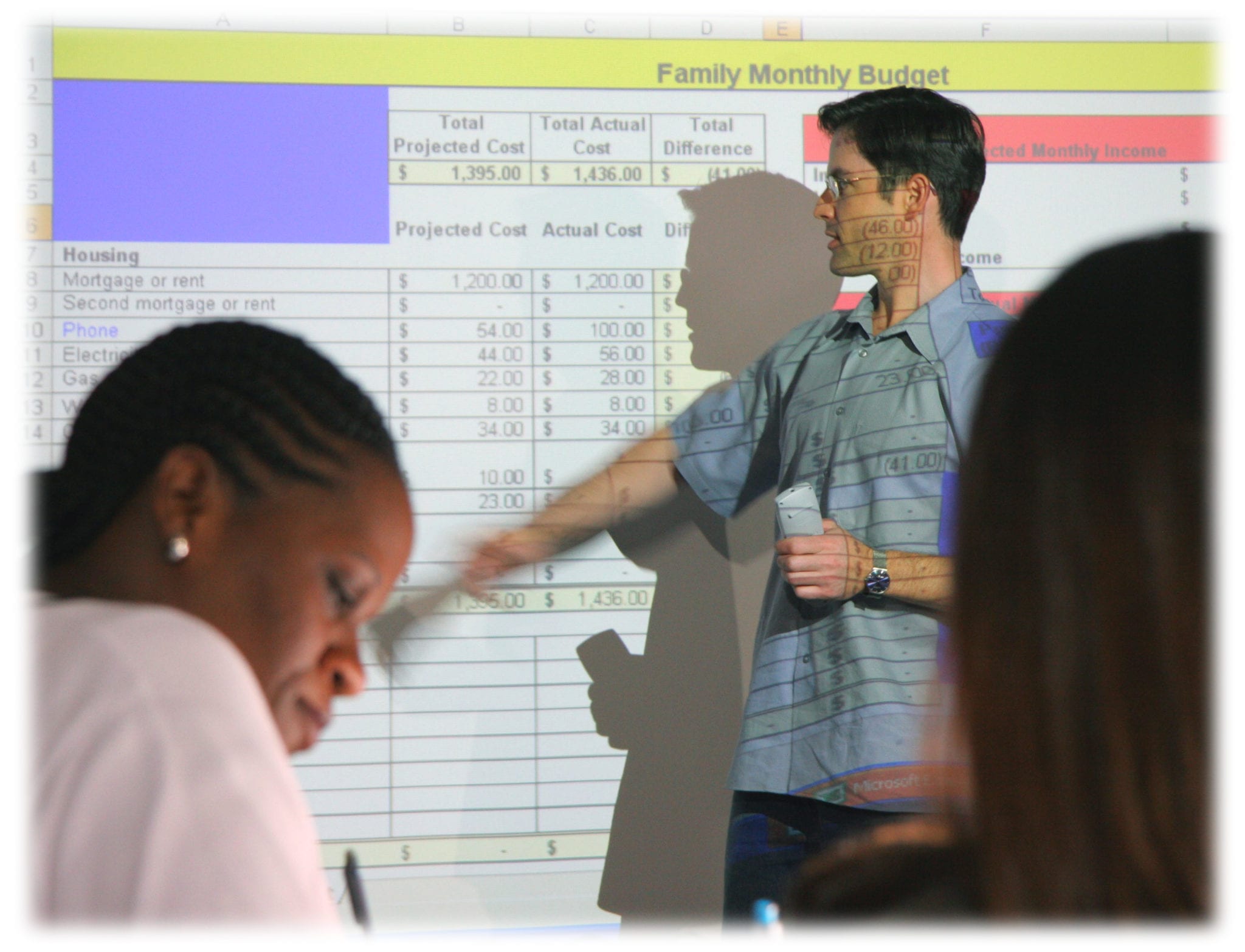

Through the camp, Wade and Lizz heard about the Museum’s United Way of Central Florida-funded Financial Fitness class for families. With no money in saving, they decided to try it out.

Wade and Lizz took the classes seriously and worked closely with their Museum advisor to stick to their household budget and plan ahead.

The goal of financial fitness classes is to help train your mind to determine what are “wants” and what are “needs.” The goal for many families in this program is to have $300 in savings to help with any crisis that may arise.

Wade and Lizz recognized that switch in their thinking when Lizz received a bonus from work and their first impulse was to save it, not spend it.

Today, Wade and Lizz have $500 in savings and Lizz has raised her credit score from 550 to 696.

When Logan started school, Lizz was able to take on more hours at work and she and Wade now make a combined $62,000 annually and have just purchased their first car.